open end mortgage definition

An Open-End Mortgage is an expandable loan that allows a borrower to access home equity appreciation for additional funds at a later date. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

Open-end mortgage a mortgage under which the mortgagor borrower may secure additional funds from the mortgagee lender usually stipulating a ceiling amount that can be borrowed.

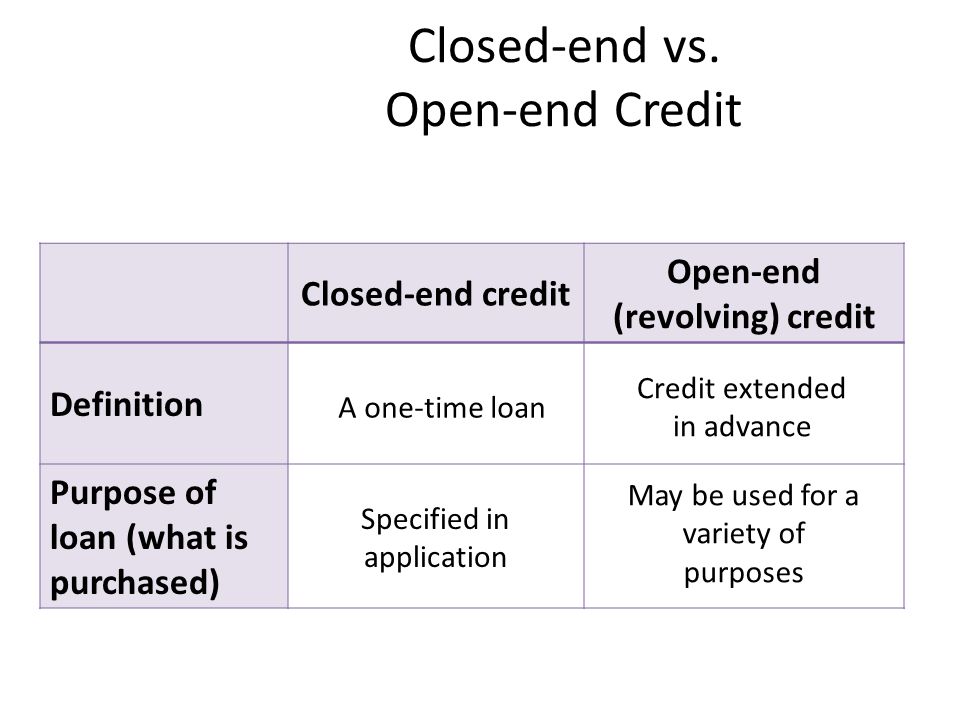

. Open-end mortgage A mortgage that permits the issuer to sell additional bonds under the same lien. Closed mortgages have more restrictions and limited flexibility for borrowers. Poole obtains an open-end mortgage to purchase a home.

You get the open-end loan use the money you need pay it back when you can and you can reuse it when the balance shows that you have money on it. Legal Definition list Open-End Lease. The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage.

Rates Wont Be This Low Forever. Earnings per share EPS. QUIZ QUIZ YOURSELF ON ITS.

An open-end loan is a more circular type of loan. Open-end mortgages combine the benefits of a traditional mortgage and a HELOC. A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under its open.

A mortgage which permits the mortgager to borrow additional funds for improvements after the original loan has been made and permits him to repay them over an extended amortization period. What is an open-end mortgage. It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a prescribed ceiling.

Once the lender approves your request to tap into your home equity you will then be allowed to borrow additional funds up until the same amount of loan that will be established for you by the lender. Open-end mortgage High School Level noun a mortgage agreement against which new sums of money may be borrowed under certain conditions. Open End Mortgage Open End Mortgage A mortgage containing a clause which permits the mortgagor to borrow additional money up to the original amount of the loan after the loan has been reduced without rewriting the mortgage.

Modified entries 2019 by Penguin Random House LLC and HarperCollins Publishers Ltd You may also like English Quiz. Payments generally can be made anytime and this means that borrowers can pay off their mortgage much more quickly and at no extra. Open-end provisions often limit such borrowing to no more than the original loan amount.

Open-end mortgages permit the borrower to go back. In other words the borrower has the right to tap into the credit made available to. Definition of open-end mortgage open-end mortgage in American English noun a mortgage agreement against which new sums of money may be borrowed under certain conditions Most material 2005 1997 1991 by Penguin Random House LLC.

It provides the borrower with just enough money to purchase a property just like a standard new mortgage. Open-End Mortgages Law and Legal Definition An open-end mortgage is a mortgage with that allows the mortgagor to borrow additional money in the future without refinancing the loan or paying additional finance charges. An A to Z Guide to Investment Terms for Todays Investor by David L.

Its circularity makes it more manageable as it doesnt have an end date. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit.

The first time the mortgagee takes out money they take out 50 as they are. A closed mortgage is pretty much the opposite of an open one. Open-end mortgage Also found in.

A mortgage that provides for future advances on the mortgage and which. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time. However interest rates for closed mortgages tend to be lower than rates for open mortgages.

Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. An open end loan also known as a line of credit or a revolving line of credit is a type of loan where the bank offers credit to the borrower up to a certain limit and giving the borrower the freedom to use the amount of credit it needs whenever it is needed. Take Advantage of Lower Rates with AmeriSave Today.

It blends some features of a traditional mortgage with some advantages of a home equity line of credit or HELOC. You cant pay off the loan early refinance or renegotiate the terms without incurring a penalty. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage.

Simply put an open-end mortgage allows you to tap into your home equity which means you can use the funds you get for whatever purpose. Open-end mortgages can provide flexibility but limit you to what you were initially approved for. An open-end mortgage on the other hand can be repaid early.

If the amount of additional bonds is restricted the mortgage is referred to as a limited open-end mortgage. A mortgagee through an open-end mortgage can obtain a specific amount of money that is called a principal amount. Ad Dont Wait Any Longer.

An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as needed. 0 0 Related Articles Real Estate Website Brownstone Zoning Zone Writ of Execution Wrap Around Mortgage Next Page. Mortgage against which additional debts may be issued.

Start the Mortgage Process Today with AmeriSave. An Open-end Mortgage is a distinct sort of house loan in which the client can utilize the loan money as required even when theyve bought the property. Legal Financial.

Open End Mortgages A Comprehensive Guide Smartasset

What Is The Difference Between Closed And Open Ended Funds Quora

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Open End Mortgage Loan What Is It And How It Works

Open End Mortgage Loan What Is It And How It Works

What Is An Open End Mortgage Rocket Mortgage

Open End Mortgages A Comprehensive Guide Smartasset

Consumer Loan Types And Categories Of Consumer Loan With Example

Open End Mortgage Loan What Is It And How It Works

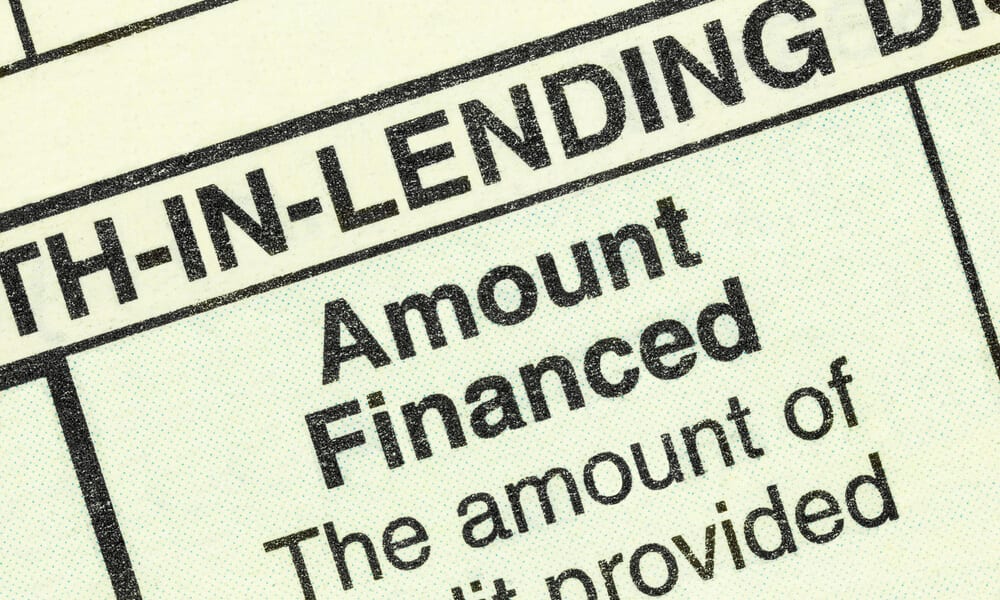

Truth In Lending Act Tila Consumer Rights Protections

What Is Open End Credit Experian

Open End Mortgage Loan What Is It And How It Works

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/thinkstockphotos-83590545-5bfc348446e0fb0083c21e19.jpg)

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)