does florida have capital gains tax on real estate

Long-term capital gains tax is a tax applied to assets held for more than a year. The state of florida does not have a state income tax and it also does not have a capital gains tax regardless of your state of residency.

State Taxes On Capital Gains Center On Budget And Policy Priorities

Calculate the capital gains tax on a sale.

. You have lived in the home as your. If youre selling a property you need to be aware of what taxes youll owe. The income tax percentage in Florida is 0 as noted on the table but you are still responsible for paying Social Security 62 and Medicare 145.

500000 of capital gains on real estate if youre married and filing. Capital Gains Tax In FL Perhaps the most important tax issue to be aware of when buying or selling a home in Florida is capital gains. Read on to learn about capital gains tax for primary residences second homes investment.

1 week ago Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt. Capital Gains Taxes Considerations for Selling Florida Real Estate. Residents living in the state of Florida though there are those who can see a long-term capital gains tax rate as high as.

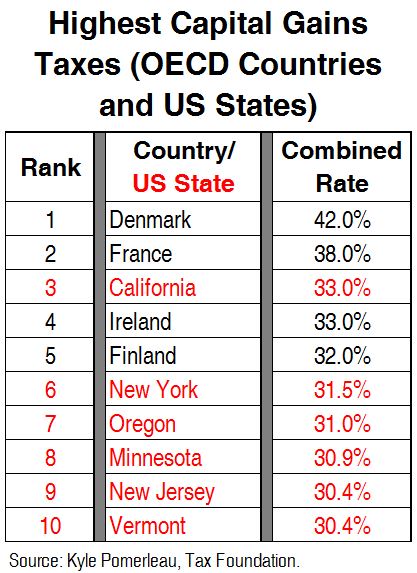

Compare these to California where residents owe. There is no Florida capital gains tax but you still have to pay federal taxes if you sell a home in the state. What is the capital gain tax for 2020.

250000 of capital gains on real estate if youre single. Florida capital gains tax isnt levied on asset profits. The Florida income tax code piggybacks the federal income tax code for treatment of capital gains of corporations.

The exact tax rate youll end up paying depends on several factors including how long you owned the property and your income level. Does Florida have a capital gains tax. If you have owned and occupied your property for at least 2 of the last 5 years you can avoid paying capital gains taxes on the first 250000 for single-filers and 500000 for.

You only pay them on realized gains upon sale. Individuals pay capital gains taxes to the federal government. There is no Florida capital gains tax on individuals at the state level and no state income tax.

The long-term capital gains tax rates are 0 percent 15. Capital gains are defined as the profits you. Federal long-term capital gain rates depend on your income tax bracket the.

The State of Florida does not. Make sure you account for the way this. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria.

Texas residents also dont pay income tax but spend 18 of their income on real estate taxes one of the highest rates in the country. Generally speaking capital gains taxes are around 15 percent for US. The IRS typically allows you to exclude up to.

Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning more.

How High Are Capital Gains Taxes In Your State Tax Foundation

Tax Tips For Selling Your Florida House

Short Term And Long Term Capital Gains Tax Rates By Income

How Are Capital Gains Taxed Tax Policy Center

Guide To The Florida Capital Gains Tax Smartasset

Tax Tips For Selling A House In Florida Florida Cash Home Buyers

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Real Estate Capital Gains Tax Rates In 2021 2022

How To Know If You Have To Pay Capital Gains Tax Experian

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Selling Property In Florida As A Non Resident

Capital Gains Tax In The United States Wikipedia

The States With The Highest Capital Gains Tax Rates The Motley Fool

Capital Gains Tax Rates For 2022 Vs 2021 Kiplinger

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Capital Gains Tax On Real Estate And Selling Your Home In 2022 Bankrate